Payable now supports cash visibility by currency with automated reconciliation 🚀

The Problem: You have multiple bank accounts, you receive payments from multiple parties and you have to log in to multiple bank portals to understand your cash, and know who hasn't paid you!

The Solution: Connect your corporate bank accounts, add your customer/supplier details, and we'll find the money for you.

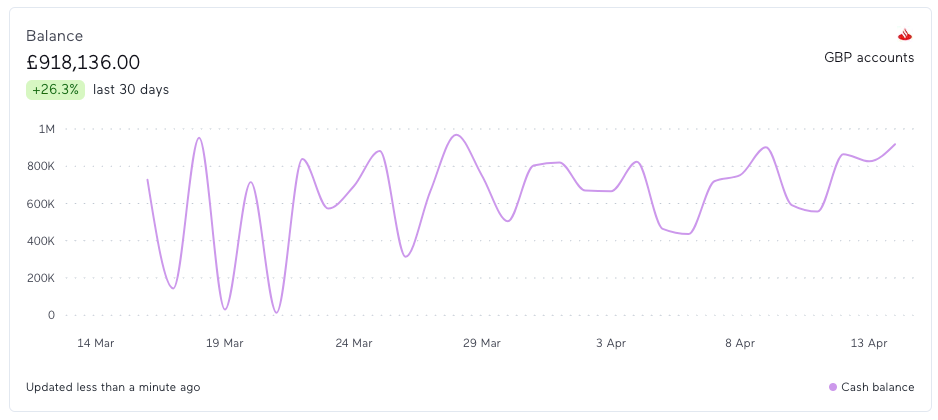

Cash Breakdown by Currency

See a breakdown of your bank account balances over the past 30 days, across all your currencies—full cash visibility with a single dashboard.

You can add all your banking partners to Payable and have real-time cash visibility across all your currencies.

Payable supports integrations with the CMA 9, also including all key European banks such as BNPs, SocGen, JPM, and many more. If you want to know more about our bank connectivity please reach out

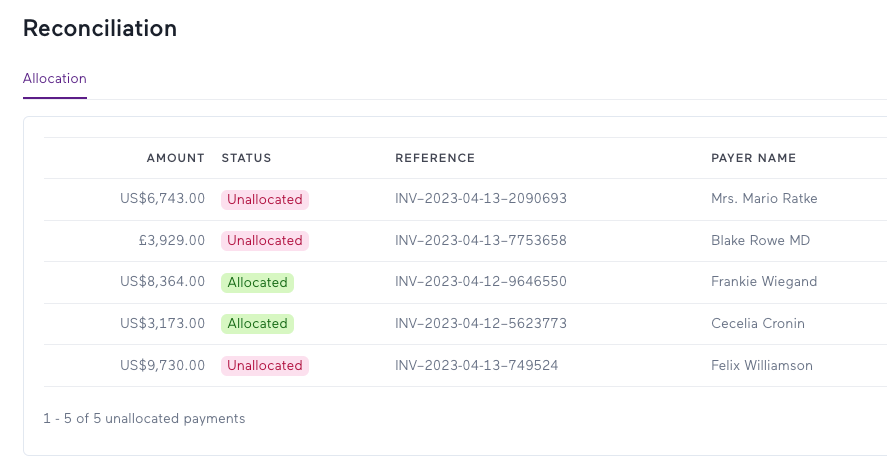

Allocation of funds - Reconciliation

Instantly know exactly who has paid you what with automated reconciliation. Track all your customer and supplier account balances in real-time, to know precisely who paid you when and who still owes you money.

How does it work?

Payable can find the money/payments for any customer, supplier or party that you need to reconcile funds.

- First, connect your bank data and payment data into Payable;

- Add your payer details e.g. customers/suppliers/users that you need to reconcile payments for;

- Lastly, add the invoice data or what payments you are expecting to receive.

Reconciliation becomes so hard because the payer's name and the name that appears in the bank statement are not always right. The Payable algorithm learns when a user fixes a name to make sure it gets reconciled the next time get the transaction from the bank.

Our algorithm uses a combination of names, references, and bank account details to automatically reconcile money.

Use cases (there are too many! 🤓)

A lender could create many "customer accounts", and use Payable to know when an invoice has been paid, not paid, underpaid, or overpaid across their customer accounts.

A BNPL company could track the balances for both the borrower and their merchants.

A neo-bank could create many "custody accounts" to reconcile the cash held in the bank and customer funds.

A property/rental company could create different "property accounts" to understand who of their tenants hasn't paid.

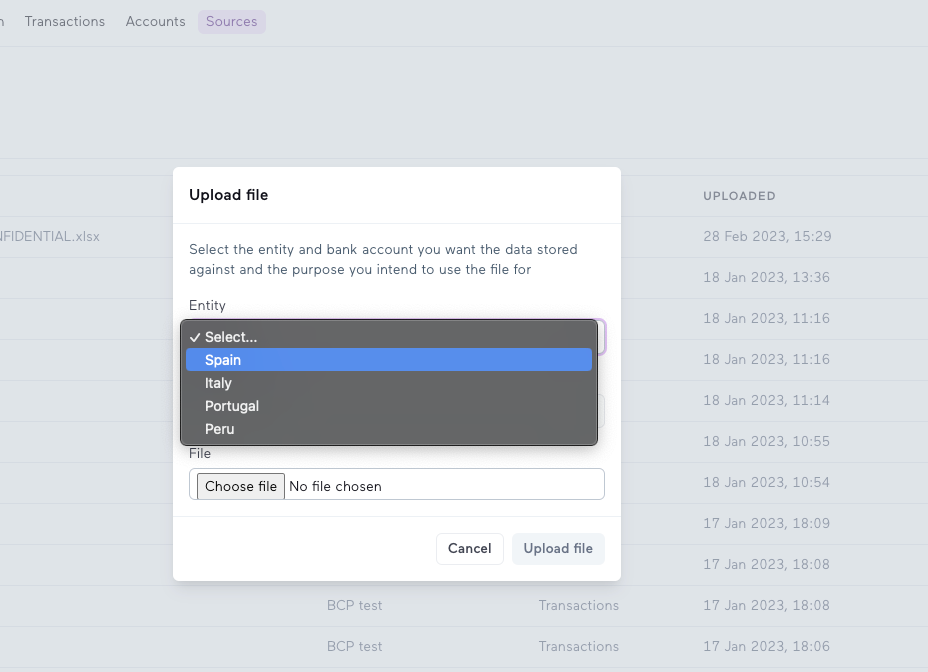

Upload any bank files and payment data

Some banks do not have treasury APIs but finance teams do require to understand their cash and reconcile funds. Some of our customers have banks across the globe including the Cayman Islands, all the way to Peru and Colombia 💃.

Finance teams can manually upload their bank and PSP file to Payable, we will clean the file to track the debits, the credits and the balances and use it as another data source. Treasury and finance teams will get the same insights and reconciliation features as a direct bank integration.

Really excited about these new features! Stay tuned for new product updates, and reach out if you want to know more about how Payable helps treasury and finance teams scale their operations.

Daniel

Announcements

Introducing Payable 2.0 - one platform to optimise working capital, make fast liquidity decisions and move your cash metrics in real-time

13 Apr 2024

Today, we’re excited to launch Payable 2.0 which is our evolution to a more connected, intelligent and automated platform for finance teams to track their cash flows in real-time.

Cash Management

Mastering 13-week direct cash flow forecasts

26 Mar 2024

Knowing how your cash flow will behave in the future is crucial for the success and sustainability of any company. One way to achieve this is through the use of a 13-week direct cash flow forecast, which provides a detailed projection of a company's inflows and outflows over a specific time period.