In the last post, we explored banking APIs and how bank connectivity is key for a company to successfully scale.

As corporate banking customer, there are a few different API types that will 10X your operations as a payments or treasury team. Here we will deep dive into what they are and how they will benefit your business.

Payment Initiation API

You want to pay your customers, suppliers and users in the most efficient way, but before leveraging a banking API payment operators often depend on spreadsheets to instruct payments. These are often repetitive to populate, holding data like known payee information, and must be uploaded to corporate bank portals to initiate the payment. Then another colleague will log in to approve the payments. Finally you have to log back in to know if the payment has been processed.

The purpose of a payments API is simple - to move money. They allow you to instruct your corporate bank to move money from one bank account to another, regardless of whether you’re making batch, international or high value payments.

Using banking APIs for payment initiation delivers a better experience than uploading a bank file or a spreadsheet to the bank portal, as they support enriched data, including remittance details and references that can improve your reconciliation and drive efficiencies for Accounts Payable and Accounts Receivable processing. Plus, each payment request gets a unique payment reference ID to reduce payment errors and eradicate duplicates.

When a payment operator is uploading a file into their bank portal, it must follow the right format before selecting the type of payment rail, as the bank will not allow you to upload the same format for Faster Payment, SEPA, or a BACS payment.

It’s important as a business to have the ability to instruct a range of payments, however doing this through a bank portal will require a deep knowledge of different file structures. Leveraging payments APIs frees treasurers and payment operators of understanding and creating different file formats, because the sender has access to several methods for sending the payment. Using an aggregator with a slick user interface will further abstract this complexity for you, driving revenue for your business and optimising for lower costs.

The other key benefit is the ability to get real time payment statuses. For finance, treasury, operations and product teams, knowing where the money you’re sending is on-demand ultimately supports greater revenue for the business.

Balances API

Knowing your balance is key to understanding your cash position, confidently forecasting business performance and taking key decisions.

The balances API benefits all the teams in your business that touch money, but has a higher value for treasury and finance management positions as it gives you an idea of your cash position, reconciliation and tracking client funds.

A good corporate banking API delivers up-to-the-second amounts of currencies held across different accounts, so it can be reconciled with your general ledger. Depending who you are banking with, you can access this either through an open banking API or a premium API offering. The difference here ultimately comes down to cost of access. Some banks don't offer any APIs but support a host-to-host solution that enables you to download the bank statements and could be converted into an API.

Before embarking on a direct integration, beware that different banks offer different ways of communicating balances, as there is a lack of standardization across corporate bank APIs, so we don't recommend integrating directly with them yourself.

Thanks to bank API aggregators, there is a solution to support different treasury and finance functions in multi-banked companies - from the Treasurer, to the Controller, to Audit and even the CFO. You can immediately understand the cash position and monitor cash movements across your corporate bank accounts and Payment Service Providers.

Understanding your corporate bank accounts balances enables you to do daily, weekly and quarterly tasks more quickly; from making decisions before approving or sending a payment to forecasting cash burn over time.

For a complete understanding of the safeguarded funds you hold, you need to track balances from a bank account level, to a customer level, which can be achieved by using virtual accounts or using a sub-ledgers.

Transactions API

Whilst a balances API gives you an overview of your cash in any account, the transactions API provides detailed, line-by-line data on all the transactions in any account.

When operating at scale and processing many transactions, this will help you:

- Increase efficiency: A transactions banking API can streamline the process of finding a transaction and automatically reconcile it against an invoice or Payment Service Provider payout, in any currency.

- Improve security: By integrating with an API, organizations can ensure that financial transactions are pulled from the bank account accurately, instead of manually going to the bank statement to make sure payments happened.

- Upgrade reporting accuracy: By integrating a transactions API with other systems, such as accounting or enterprise resource planning (ERP) systems, organizations can improve the accuracy and completeness of financial data. This can help to improve financial reporting and forecasting.

As organizations grow, the volume of financial transactions they process increases exponentially. Having rich data on the money being processed is crucial for efficient reconciliation, because it is easily readable by machines and humans; increasing automatic match rates and reducing number of exceptions or breaks.

This helps organizations to scale their financial operations to meet growing transaction volumes, without adding significant manual processes or increasing the risk of errors.

Conclusion

There are three most common corporate bank APIs for treasury; payment initiation, balances and transactions. We see a huge amount of benefit for businesses as in the coming years banks stop using file based secure connections entirely and continue building high quality treasury APIs.

Payable offers a fast go-live treasury dashboard and banking API modernising the treasury and payment function in scaling companies. Come and talk to us!

Announcements

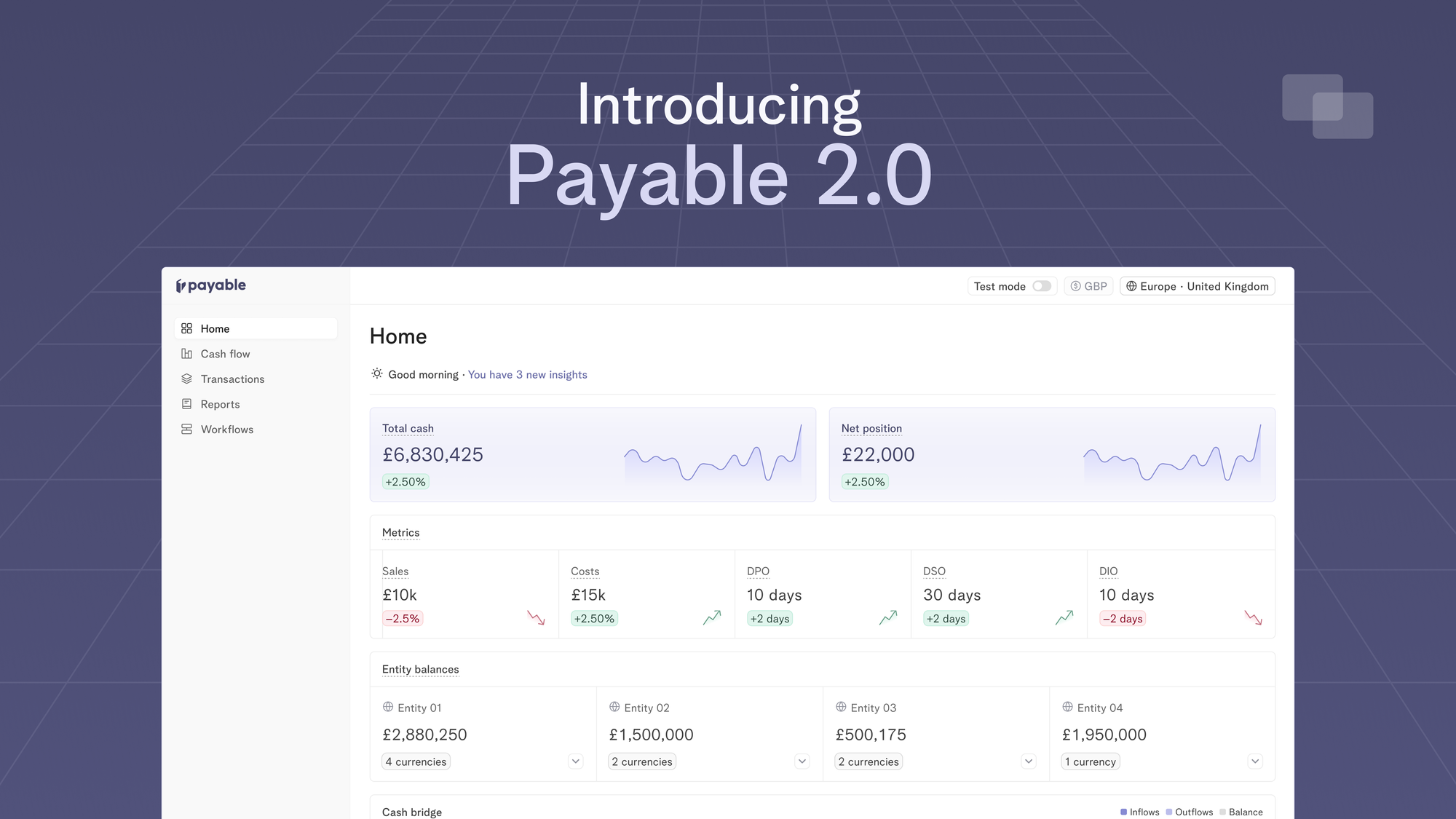

Introducing Payable 2.0 - one platform to optimise working capital, make fast liquidity decisions and move your cash metrics in real-time

13 Apr 2024

Today, we’re excited to launch Payable 2.0 which is our evolution to a more connected, intelligent and automated platform for finance teams to track their cash flows in real-time.

Cash Management

Mastering 13-week direct cash flow forecasts

26 Mar 2024

Knowing how your cash flow will behave in the future is crucial for the success and sustainability of any company. One way to achieve this is through the use of a 13-week direct cash flow forecast, which provides a detailed projection of a company's inflows and outflows over a specific time period.